62+ conversion from accrual accountng to cash accounting worksheet

The Accounting Cycle Revisited 3-46. Under the accrual basis of accounting net income is usually the same as net cash flow from operating activities.

Proposals Budget Proposal Template Cost Proposal Template Budget Template Proposal Templates Budgeting

Illustration of Reversing EntriesAccruals 3-43.

. As a result the cash basis system also. To convert the fund financial statements from the modified accrual basis of accounting to the. 62 Special Reports an OCBOA is any one of.

With the adoption of accrual accounting as the basis for accounting records applied to accounting in the public sector of many countries governments have. Using Reversing Entries 3-43. Cash vs Accrual Accounting Adjusting entries MOD 3 Lesson Notes 4 ROE ROA Adjusted ROA RNOA Mod 4 Z-score Analysis Mod 5 Mod 6 Analyst Adjustments For Z-score calculation use just the current data.

In the Adjustments there is a credit of 2000. Interim Financial Reports are on a cash basis. Through a focus on accounting transactions real-world problem-solving and engaging industry examples Weygandt Financial Accounting 11th edition demonstrates how accounting is an exciting field of study and helps connect core financial accounting concepts.

This worksheet will not only help in keeping the financial statements in balance but will provide adjustment. Cash-Basis Accounting versus Accrual-Basis Accounting 3-38. The accrual basis of accounting is used to record revenues and expenses in the period in which they are earned irrespective of the timing of the associated cash flowsHowever there are times usually involving the preparation of a tax return when a business may instead want to report its results under the cash basis of accounting.

University Of the South Pacific Lecturer. Record and Summarize Basic Transactions 3-9. The cash basis involves only.

On the worksheet the Office Supplies account has a debit balance of 9000 on the Unadjusted Trial Balance. Illustration of Reversing EntriesDeferrals 3-44. Theoretical Weaknesses of.

Record a deposit of124425 made on. Accrual accounting records revenue only when it is earned. To convert net income from an accrual number to a cash number you must add back depreciation.

Add back all expenses for which the company has received a benefit but has not yet paid the supplier or employee. Conversion from Cash Basis to Accrual Basis 3-40. Financial Statements for a Merchandising Company 3-35.

Ratio Analysis Cash conversion cycle AR days Inventory days AP days Leverage Analysis Traditional Valuation Model Format of the MidTerm. A company can convert net income to net cash flow from operating activities through either the direct method or the indirect method. Sometimes it might be necessary to perform accrual to cash conversion for the following reasons.

To understand a business you have to understand the financial insides of a business organization. Create great accountantsUpholding industry standards this edition incorporates new data analytics content and up-to-date coverage of leases revenue recognition financial instruments and US GAAP. CashBasis of Accounting The cashbasis of accounting is a basis of accounting that the entity uses to record cash receipts and disburse ments.

Net Investment Income Tax. A The company has to file tax returns on a cash basis. At year-end the CPA must convert the subfund to the full accrual basis and include its reporting under the appropriate proprietary fund type.

To convert from cash basis to accrual basis accounting follow these steps. After fiscal year end conversion to the Modified Accrual Accounting Basis is done. AF101 Introduction to Accounting and financial management Baron Flowers WORKSHEET TO CONVERT TRIAL BALANCE TO ACCRUAL BASIS December 31 year 2 Cash basis Adjustments Accrual basis Account title Dr.

Reduce basis by cash excess would be gain Reduce basis for inventoryaccounts receivable basis if. Theoretical Weaknesses of the Cash Basis 3-43. Financial statement amounts reported on the accrual basis of accounting.

See worksheet on Form 5452 Also have AICPA Corporations and Shareholders Tax Resource Panel practice. When applying the cashbasis of accounting transactions are recognized based on the timing of cash re ceipts and disbursements. The accrual basis is used to record revenues and expenses in the period when they are earned irrespective of actual cash flows.

A company pays a sales tax before it receives the cash for a sale. The Budget is presented on th Modified Accrual Accounting Basis. Also the CPA must include the project ordinance as supplementary information in the audit report.

Accrual to Cash Example. Would maintain the subfund on the modified accrual basis of accounting. B Reconciliation of accrual accounts with cash accounts is needed.

Intermediate Accounting 17th Edition is written by industry thought leaders Kieso Weygandt and Warfield and is developed around one simple proposition. Lets assume and Alan runs a business that supplies his clients with gadgets. 465 Conversion of Accrual Income to Net Cash Flows from Operations.

Sometime there is big need to convert accrual basis accounting to cash basis accounting because. Accounting Information System 3-3. Preparing Financial Statements 3-30.

Business organisation has to fill tax return on the cash basis accounting. Summary of Reversing Entries 3-45. Hybrid or Mixed Basis Under the hybrid system of accounting incomes are recognized similar as in Cash Basis Accounting ie.

Other side in cash accounting we record only incomes which received in cash and expenses which have been paid in cash. They also need to reconcile accrual basis accounting. Accrual basis accounting is the process of recording financial transactions when they occur rather than when the buyer pays.

This report includes payrolls through September 2i11 cash. Conversion from Cash Basis to Accrual Basis 3-40. A statutory basis of accounting for example a basis of accounting insurance companies use under the rules of a state insurance commission.

234 Parents Accounting for Guarantee of Subsidiary Debt 37 24 Measurement 38 241 Offer to Settle Litigation 38 242 Comparison of the Probability-Based and Expected Value Cash Flow Accounting Models 39 243 Application of Present-Value Techniques to the Measurement of a Contingent Liability 40. What the net income of the company would have been had the company used a cash accounting basis rather than accrual accounting. This can be done by 1 Direct Method or 2 Indirect Method.

Which of the following is true of accrual basis accounting and cash basis accounting. Where in the fund statement revenue equals the cash.

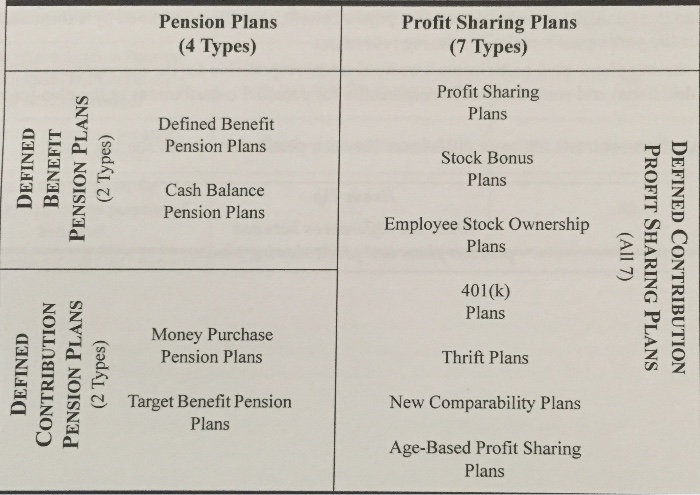

Retirement Planning Employee Benefits Flashcards Chegg Com

Cash Basis To Accrual Basis Conversion Example Showing Actual Calculations Requir Spreadsheet Template Business Printable Worksheets Financial Plan Template

Accrual To Cash Conversion Excel Worksheet Double Entry Bookkeeping Accrual Conversion Calculator Bookkeeping

How To Convert Accrual To Cash Basis Accounting Http Www Svtuition Org 2014 07 How To Convert Accrual To Cash Accounting Education Learn Accounting Accrual